Medtech

Five Defense Investments Rise Amid Navy Spending Surge

Five defense investments rise amid the U.S. Navy’s spending surge as America embarks on what could be the biggest procurement cycle since President Ronald…

Five defense investments rise amid the U.S. Navy’s spending surge as America embarks on what could be the biggest procurement cycle since President Ronald Reagan’s administration in the 1980s.

The five defense investments’ rise is boosted by President Biden signing legislation to give the U.S. Department of Defense (DoD) $797.7 billion in discretionary spending for fiscal year 2023, up $69.3 billion, or 9.5%, compared to fiscal year 2022. The amount appropriated topped the president’s budget request by $36.1 billion.

The spending is aimed at developing, maintaining and equipping the U.S. military and intelligence community of the United States. The legislation also expanded weapons procurement by $5.9 billion, a $1.1 billion increase from President Biden’s request, to allow the Navy to obtain 2,365 munitions as Russia’s war against Ukraine rages. At the same time, China is increasing its threatening military flyovers and other provocations against Taiwan and additional countries in the Asia-Pacific region.

The bipartisan support for increased U.S. defense spending harkens back to President Reagan’s pro-military administration that began with his inauguration on January 20, 1981, then ended at the conclusion of his second term on January 20, 1989.

Five Defense Investments Rise Amid Navy Spending Surge

The five defense investments outperformed the market in 2022 by rising when the major indices were falling. The momentum appears to be advancing for 2023 on the heels of President Biden signing legislation to enhance U.S. warfighting capabilities.

The omnibus budget bill signed by the president on Friday, Dec. 29, provided $31.96 billion, or $4 billion more than requested by the president, to procure 11 Navy ships. Other appropriations included three DDG-51 guided missile destroyers, two SSN-774 attack submarines, one Frigate, one T-AO Fleet Oiler, two expeditionary fast transports, one towing, salvage and rescue ship and one LPD Flight II amphibious transport dock.

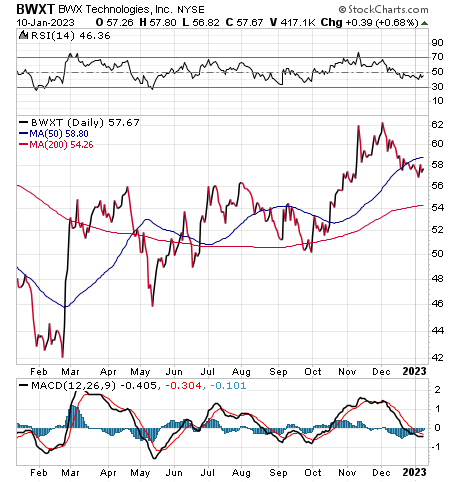

BWX Technologies Is One of Five Defense Investments to Rise

BWX Technologies, Inc. (NYSE: BWXT), a Lynchburg, Virginia-based supplier of nuclear components and fuel to the U.S. government, offers precision manufacturing for the U.S. Navy’s submarines and aircraft carriers. The latter opportunity could be significant for BWX, as the U.S. Navy is focusing on rebuilding its aging fleet and procuring submarines and aircraft carriers.

After years of underinvestment, the United States may be in the early stages of the “strongest U.S. Navy procurement cycle” since Reagan’s presidency, according to BofA Global Research. BWT Technologies provides technical, management and site services to support the operation of complex facilities, environmental restoration activities, precision parts, services and fuel. The company also maintains a highly skilled security force to safeguard its facilities where complex operations are performed.

The U.S. Navy currently has 296 deployable ships, as compared to the goal it set in 2016 of 355 ships. Since 2019, the Navy has been working on creating a new goal of anywhere between 321 and 404 manned ships and 24-45 large, unmanned vehicles (UVs).

“A congressionally mandated Battle Force Ship Assessment and Requirement (BFSAR) report delivered to Congress in July of 2022 reportedly calls for 373 battle force ships, but the details surrounding the report are currently classified,” according to a recent BofA research report.

BofA Sets $66 Price Target on BWX Technologies

BWX Technologies received a $66 price target from BofA, implying a 1.1x relative multiple on defense prime contractors. The premium is supported by the company’s exposure to the U.S. Navy, its monopoly on nuclear-powered ships and its diversification efforts.

Potential risks include future cuts to the DoD budget, changes in contracting terms that could hurt profit margins and possible market share loss. The U.S. government is BWX’s largest customer and accounts for about 90% of the company’s revenues, according to BofA.

Outperformance could occur if BWX achieves better-than-forecast operating results and margins, demand increases for nuclear aftermarket at power plants and the need for missile tubes on the Virginia-class and Ohio-class submarines grows. Acquisitions also could provide upside, BofA wrote in a research note.

Chart courtesy of www.stockcharts.com

Leidos Leaps into Five Defense Investments to Rise

Another of the defense stocks ripe for investment is Leidos Holdings (NYSE: LDOS), based in Reston, Virginia. Previously known as Science Applications International Corporation, the company is engaged in U.S. defense, aviation, information technology and biomedical research, providing scientific, engineering, systems integration and technical services.

BofA set a price target of $130 on Leidos, with a view that the company should trade in line with the defense prime contractors amid strong U.S. national security demand for innovative technologies and solutions. The company also has solid free cash flow, countered by a lumpy contract award environment, near-term supply chain pressures and mounting concerns about labor inflation.

Risks to reach the price target are cuts to the U.S. government budget compared to expectations, increased competition from non-traditional competitors and problems integrating M&A, hiring the right personnel, containing costs, estimating costs and executing on fixed price contracts. The company also could incur reputational risk.

Potential outperformance could come from a better-than-expected federal budget allocated to innovative technologies and modernization, inexpensive and well-integrated M&A activity, along with unexpected capital return to shareholders through dividends or share buybacks, market share gains, or better-than-expected margin expansion, BofA wrote.

Chart courtesy of www.stockcharts.com

Michelle Connell, who heads Dallas-based Portia Capital Management, called Leidos a strong mid-cap defense stock that is not covered as prominently as the large-cap stocks in the industry. The company has a large domestic customer base that produces 90% of its revenues.

Leidos serves the DoD, U.S. intelligence agencies, Department of Homeland Security and the Department of Veteran Affairs. With foreign government revenues currently accounting for less than 10% of the company’s total sales, that segment of the business could present “a great opportunity,” Connell counseled. The United Kingdom, Germany and other NATO allies are eyeing improvement in their military intelligence and cyber security efforts.

Strong, consistent cash-flow generation during the last 10 years has reached at least $500 billion, Connell continued. She gives the stock an upside potential of 15%.

Michelle Connell leads Dallas-based Portia Capital Management.

Teledyne Joins Five Defense Investments to Rise

Teledyne Technologies Incorporated (NYSE:TDY), of Thousand Oaks, California, also is one of five defense investments on the rise amid Russian’s invasion of Ukraine. One of the company’s business units gained an award for 500 additional robots requested by the U.S. Army and Navy.

Teledyne FLIR Defense, part of Teledyne Technologies Inc., announced that it gained new orders worth $62.1 million from the U.S. Armed Services for its advanced, multi-mission robots. The U.S. Army, Navy and other command centers placed orders for nearly 500 more Centaur unmanned ground systems (UGS), including additional spares, antennas and payload mounting kits. The award raises the value of the original Man Transportable Robot System Increment II (MTRS Inc. II) contract from roughly $190 million to more than $250 million.

Explosive Ordnance Disposal (EOD) teams use the Teledyne FLIR Centaur ground robot to disable unexploded ordnance (UXO), improvised explosive devices (IEDs) and landmines, as well as perform other dangerous tasks. Operators can quickly attach different sensors and payloads to the robot to address additional dangerous missions, including chemical, biological, radiological and nuclear (CBRN) threats.

In 2017, the Army chose Centaur as its MTRS Inc. II solution for a multi-year program. Since then, other U.S. military branches have deployed Centaur to their EOD units as a new or replacement ground robot system. Orders totaling more than 1,800 Centaurs have come from the Army, Navy, Air Force and Marine Corps since 2020.

Chart courtesy of www.stockcharts.com

U.S. Army Veteran Woods Seeks out Defense Investments on the Rise

Jim Woods, a seasoned investment guru and the leader of the Bullseye Stock Trader advisory service, recommends stocks and options that include defense investments. Woods, who concurrently heads the Intelligence Report investment newsletter, is a former Army paratrooper who has strategically invested in defense stocks. In fact, he recently recommended the stock and options in a traditional defense investment.

Paul Dykewicz meets with Jim Woods, head of Bullseye Stock Trader.

Woods also teams up with Mark Skousen, the head of the Forecasts & Strategies investment newsletter and a leader of the Fast Money Alert trading service that invests in stocks and options. Skousen queried SpaceX and Tesla (NASDAQ: TSLA) founder Elon Musk at the annual Baron Investment Conference held in New York on Nov. 4. Skousen, who also is a Chapman University Presidential Fellow and recently was named the first Doti-Spogli Chair in Free Enterprise at its Argyros School of Business and Economics, recommended Tesla with Woods in Fast Money Alert earlier this week due to the stock’s reduced valuation, after plunging 66.3% in the last year.

Mark Skousen, a scion of Ben Franklin and chief of Fast Money Alert, meets Paul Dykewicz.

Skousen and Woods, co-leaders of the Fast Money Alert trading service, combined to produce a short-term gain of nearly 10% with their Oct. 3 recommendation of defense, space and cyber consulting firm Booz Allen Hamilton (NYSE: BAH), of McLean, Virginia. The call options they recommended soared 239.27% in just 28 days before they advised selling

Two Funds Find Spots Among Five Dividend Investments on the Rise

Investors who are looking for a diversified portfolio of defense and aerospace stocks have two exchange-traded funds (ETFs) to choose from: Invesco Aerospace & Defense (PPA) and iShares U.S. Aerospace & Defense (ITA). However, the returns between the ETFs have varied considerably in recent years because they track different indexes and can have very varied holdings, said Bob Carlson, a pension fund chairman who also heads the Retirement Watch investment newsletter.

PPA follows the SPADE Defense Index. The fund recently held 56 stocks, and its top holdings were Boeing (NYSE: BA), Raytheon (NYSE: RTX), Lockheed Martin (NYSE: LMT), Northrop Grumman (NYSE: NOC) and General Dynamics (NYSE: GD). Its 10 largest positions were 56% of the ETF.

Chart courtesy of www.stockcharts.com

ITA follows the Dow Jones U.S. Select Aerospace & Defense Index. Its top holdings recently were Raytheon, Lockheed Martin, Boeing, TransDigm (NYSE: TDG) and Northrop Grumman. It held 35 stocks, and the top 10 holdings of the ETF comprised 75% of the portfolio.

Chart courtesy of www.stockcharts.com

China’s COVID Cases Jump After Easing Zero-Tolerance Policy

Satellite images of Chinese cities have captured crowding at crematoriums and funeral homes, with the world’s most populous country continuing its battle with a new wave of COVID-19 infections after relaxing its strict pandemic restrictions.

The number of COVID-19 cases has reached a record high in mainland China, according to the European Centre for Disease Prevention and Control (ECDC). However, the number of cases in China has fallen in recent weeks, possibly due to a reduced number of tests to detect cases.

The U.S. government will began requiring negative COVID-19 tests starting Thursday, Jan. 5, for all passengers seeking to enter the country from China after the latter country reported a spike in COVID-19 cases. France and several other countries also mandated clean COVID-19 tests for passengers arriving from China, reflecting global concern that new variants could emerge in the ongoing outbreak.

China has been accused of a lack of transparency since the virus emerged in late 2019. The worry is that China may not be sharing data about any evolving strains that could spark fresh outbreaks in other countries.

Along with the United States, Japan, India, South Korea, Taiwan and Italy have announced passengers from China would need to test negative for COVID. An internal meeting of China’s National Health Commission estimated that up to 248 million people contracted the coronavirus over the first 20 days of December. COVID-19 is roaring through cities in China after its government recently chose to ease its strict anti-virus controls.

China’s leaders reconsidered their zero-tolerance policy for COVID cases that had been in effect the last three years. Large protests in many of China’s cities in November 2022 may have swayed the nation’s leaders to modify the policy of locking down communities where COVID breaks out.

U.S. COVID Cases Top 101.3 Million

COVID-19 cases in the United States totaled 101,345,042, while deaths reached 1,097,615, as of Jan. 11, according to Johns Hopkins University. Until recent news that estimated China had 248 million cases of COVID-19, America had the dreaded distinction as the nation with the most coronavirus cases and deaths. Worldwide COVID-19 deaths soared to 6,712,324 people, with total cases of 665,088,033, Johns Hopkins announced on Jan. 11.

The U.S. Centers for Disease Control and Prevention reported that 268,546,218 people, or 80.9% the U.S. population, have received at least one dose of a COVID-19 vaccine, as of Jan. 4. People who have completed the primary COVID-19 doses totaled 229,254,623 of the U.S. population, or 69.1%, according to the CDC. The United States also has given a bivalent COVID-19 booster to 45,673,736 people who are age 18 and up, equaling 17.7% as of Jan. 4, 17.3% as of Dec.28, rising from 16.8% the previous week, up from 16.3% the week before that one and and jumping from 15.5% the preceding one.

Ukraine’s President Volodymyr Zelensky’s secret Dec. 21 flight to Washington, D.C., let him to talk face-to-face with U.S. President Joe Biden to successfully advocate for additional military supplies to defend against Russia’s continuing attacks. Zelensky’s address to a joint session of Congress that evening also seems to have appealed to many U.S. lawmakers. The surprise visit marked Zelensky’s first international trip since Russia’s invasion.

Russia sent 16 so-called “kamikaze” drones into Ukraine under the cover of darkness early Friday morning, Dec. 30, a day after firing dozens of missiles at civilian targets, power plants and other critical infrastructure. The attacks left roughly 10 million people there in darkness without heat or electricity amid frigid winter weather.

At least 76 missiles also were launched by Russia at major Ukrainian cities, including Kyiv, Odesa, Poltava, Zhytomyr, Kharkiv and Sumy, on Friday, Dec. 16, according to the Ukrainian Air Force. Russia is continuing its onslaught of intensified strikes that began in October, targeting Ukraine’s energy and civilian infrastructure.

Five Defense Investments Rise as Russia Wages War

Most recently, Russia, whose leaders describe their attack of Ukraine that began Feb. 24 as a “special military operation,” are escalating their assault of the Ukrainian city of Bakhmut. One of Russia’s military leaders said his troops had gained control of a nearby city in eastern Ukraine called Soledar.

The five defense investments rising amid Russia’s war against Ukraine include companies and funds supplying the U.S. Navy and other branches of the military as some of their weapons are sent to Ukraine to help those beleaguered people fend off attacks against them. Russia’s leaders appear intent on waging a long-term war that should continue to boost the five defense investments that aim to protect freedom around the world.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Special Holiday Offer: Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special pricing on multiple-book purchases.

The post Five Defense Investments Rise Amid Navy Spending Surge appeared first on Stock Investor.

ETF Talk: AI is ‘Big Generator’

Second nature comes alive Even if you close your eyes We exist through this strange device — Yes, “Big Generator” Artificial intelligence (AI) has…

Apple gets an appeals court win for its Apple Watch

Apple has at least a couple more weeks before it has to worry about another sales ban.

Federal court blocks ban on Apple Watches after Apple appeal

A federal appeals court has temporarily blocked a sweeping import ban on Apple’s latest smartwatches while the patent dispute winds its way through…