Medtech

KLAS IV Workflow Management 2022: Functionality Drives Recent Purchases

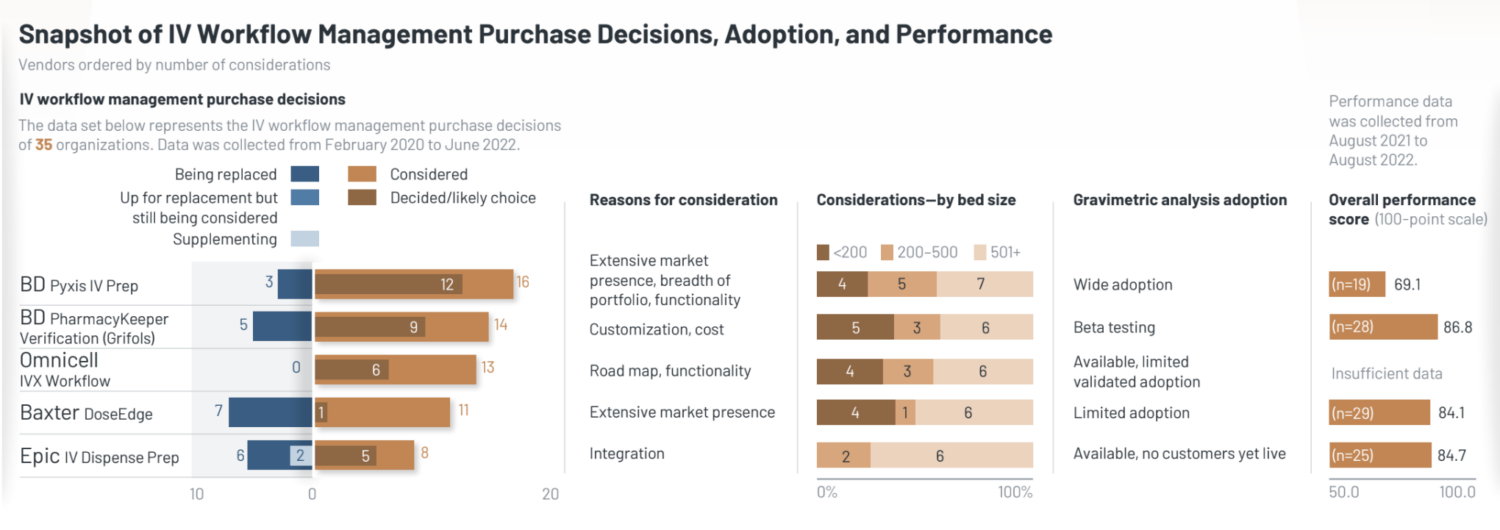

What You Should Know: – Health systems rely on IV workflow management solutions to streamline and improve pharmacy operations. Functionality has emerged…

What You Should Know:

– Health systems rely on IV workflow management solutions to streamline and improve pharmacy operations. Functionality has emerged as the most important criterion for prospective clients; however, no vendor meets all customer needs and performs at a high level, and each customer base notes gaps in functionality.

– To understand which solutions are being selected and why and help provider organizations select solutions that meet their unique needs, this new report from KLAS examines 35 recently finalized or pending purchase decisions validated by KLAS between February 2020 and June 2022. Customer satisfaction data provides additional context on which vendors best meet customer expectations.

Insights To Better Understand How Functionality Drives Recent Purchases

Each year, KLAS interviews thousands of healthcare professionals about the IT solutions and services their organizations use. For this particular report, interviews were conducted over the last 12 months using KLAS’ standard quantitative evaluation for healthcare software, which is composed of 16 numeric ratings questions and 4 yes/no questions, all weighted equally. Combined, the ratings for these questions make up the overall performance score, which is measured on a 100-point scale. The questions are organized into six customer experience pillars—culture, loyalty, operations, product, relationship, and value.

Key insights generated from the interviews are as follows:

– BD Pyxis IV Prep Leads in Considerations & Selections for Enterprise Pharmacy Portfolio, but Go-Lives Remain Challenging: BD Pyxis IV Prep leads in the number of considerations, and over one-third of all purchase decisions in this sample ultimately went in the vendor’s favor. Purchasing organizations mainly select BD due to having other BD products and established relationships with the vendor. Another selection factor is leading adoption of gravimetric analysis. While BD customers appreciate that piece, product functionality is inhibited by cumbersome workflows, causing BD’s overall performance to remain below average. As BD has grown, implementations in the past few years have been more difficult than expected, including unresolved issues with scale certifications, system crashes and inaccuracies, and insufficiently detailed reports. Customers also report a steep learning curve exacerbated by inadequate training and support. A few organizations that have gone live within the last year report smoother implementations.

– Epic Meeting Expectations; Some Customers Leaving or Supplementing Solution Due to BYOD Model for Hardware: Epic IV Dispense Prep is offered as a free add-on only to Epic customers, and a BYOD model requires them to purchase and manage hardware on their own. Of interviewed Epic organizations, about 50% seeking an IV workflow management solution consider Epic’s product, and those considering organizations usually select it. Satisfied customers appreciate the solution’s usability and integration benefits for formulary maintenance, labeling, and billing. In recent years, Epic has rolled out photo-capturing and gravimetric analysis functionality, but customers report the BYOD model has led to camera freezing and inefficient gravimetric analyses, limiting adoption compared to that of other solutions with gravimetric analysis functionality. Challenges in implementing and updating hardware due to the BYOD model are ultimately the main reasons organizations don’t select Epic or choose to replace or supplement the solution. Customers want Epic to either manage the hardware or provide guidance on what to use. Additionally, the lack of hard stops in the workflow is a safety concern for some.

– BD PharmacyKeeper Verification (Grifols) Gains Traction Due to Flexibility and Leads in Client Satisfaction: In August 2022, BD acquired Grifols’ PharmacyKeeper Verification, a solution whose consideration rate has increased more than any other product in the past couple of years. Organizations often choose the easy-to-use solution for its customizability, implementation flexibility, and EMR integration. The solution currently does not have gravimetric analysis functionality; outside of that, most customers feel the solution meets their functionality needs. They also are highly satisfied with Grifols’ ongoing support, highlighting that the vendor is one of the most responsive vendors they have worked with. Some organizations have replaced the product due to a lack of innovative technology. It is too soon to tell what impact the BD acquisition will have on customer satisfaction.

– Baxter Customers Highlight Safety Features; Lacking Innovation Causes Replacements: Baxter’s consideration rate is high thanks to their extensive network of pharmacy customers. Current customers appreciate the solution’s functionality, especially the robust safety features. Baxter’s overall selection rate is the lowest of all products due to lacking innovation and high costs. Some organizations feel the workflow is inefficient and the database is labor-intensive. The solution’s physical footprint is also larger than some organizations want. Minimal customer awareness has led to low adoption of Baxter’s new gravimetric analysis functionality.

– Functionality Is the Key Driver in IV Workflow Management Purchase Decisions: Of the 35 purchase decisions evaluated for this report, functionality is the main reason organizations choose or don’t choose a vendor, with gravimetric analysis being the most-mentioned functionality. BD Pyxis IV Prep leads in offering this technology, and Baxter and BD PharmacyKeeper Validation are often not chosen because of insufficient or missing gravimetric analysis functionality. Integration (particularly with EMRs) is the second-biggest factor in organizations’ purchasing decisions. Cost is another top consideration; the lack of add-on costs for Epic IV Dispense Prep is attractive for Epic customers, while Baxter’s high costs can be a deterrent.

ETF Talk: AI is ‘Big Generator’

Second nature comes alive Even if you close your eyes We exist through this strange device — Yes, “Big Generator” Artificial intelligence (AI) has…

Apple gets an appeals court win for its Apple Watch

Apple has at least a couple more weeks before it has to worry about another sales ban.

Federal court blocks ban on Apple Watches after Apple appeal

A federal appeals court has temporarily blocked a sweeping import ban on Apple’s latest smartwatches while the patent dispute winds its way through…