Medtech

New Unicorns In May Hit Double Digits With Two AI Companies

Ten companies joined The Crunchbase Unicorn Board last month as investors continue to downgrade unicorn portfolio values.

Ten companies joined The Crunchbase Unicorn Board in May 2023 — double the count for April 2023 but still significantly down from the 34 new unicorns in May 2022.

This new unicorn count took place in a funding environment where the most active unicorn investor, Tiger Global, is looking to sell its stakes in private companies, and investors continue to downgrade unicorn portfolio values.

The 10 companies hailed across nine different industries, and AI topped the list with two companies. Other sectors with a single new unicorn ranged from energy, biotech, robotics, enterprise SaaS and transportation among others.

Five of the new unicorns are U.S.-based and two are from China. Canada, Indonesia and Japan each counted one new unicorn this past month.

Around $5 billion of the $22 billion in global venture funding raised in May 2023 went to unicorn companies. That’s less than half of the $11 billion that unicorns raised in May 2022. The largest funding last month went to fast-fashion e-commerce platform Shein, which raised $2 billion in a single round at a reduced valuation of $66 billion.

Here are the new unicorns:

AI

- Toronto-based Cohere, a generative AI large language model developer for enterprises, raised $250 million. The funding was led by Salesforce Ventures 1, valuing the 4-year-old company at $2 billion.

- Generative video AI company Runway, based out of New York, raised a $100 million Series D led by Google. The funding valued the 5-year-old company at $1.5 billion.

Energy

- China-based Ryefield Energy, a battery energy storage company, raised $140 million led by Sparkedge Capital. The company was valued at $1.4 billion.

Agtech

- Indonesia-based eFishery, developer of an IoT feeding device for shrimp and fish, and an e-commerce platform for aquafarmers, raised a $108 million Series D led by Abu Dhabi PE fund G42 Expansion Fund. The company was valued at $1.3 billion.

Cleantech

- Massachusetts-based Gradiant helps enterprises dependent on water reduce and treat wastewater. It raised a $225 million Series D led by BoltRock Holdings and Centaurus Capital in a round which valued the company at $1 billion.

Enterprise SaaS

- Restaurant management software company Restaurant365 based in Irvine, California, raised a $135 million round which valued the company at $1 billion. The funding was led by private equity firms Kohlberg Kravis Roberts and L Catterton.

Proptech

- Proptech company Avenue One provides a platform of services from brokers, contractors and property managers for buyers of rental properties. The company based in New York raised $100 million led by WestCap valuing the company at $1 billion.

Transportation

- Tokyo-based GO, the leading ride hailing app in Japan, raised a $72 million Series D led by Goldman Sachs which valued the company at $1 billion. The company is also developing software to monitor safe driving practices.

Robotics

- Humanoid robot developer Zhiyuan Robotics based in Shanghai, raised its third funding led by Baidu Capital, valuing the company at $1 billion. The amount raised was not disclosed.

Biotech

- VectorBuilder, a gene delivery technology company headquartered in Chicago, raised a funding which valued the company at $1 billion.

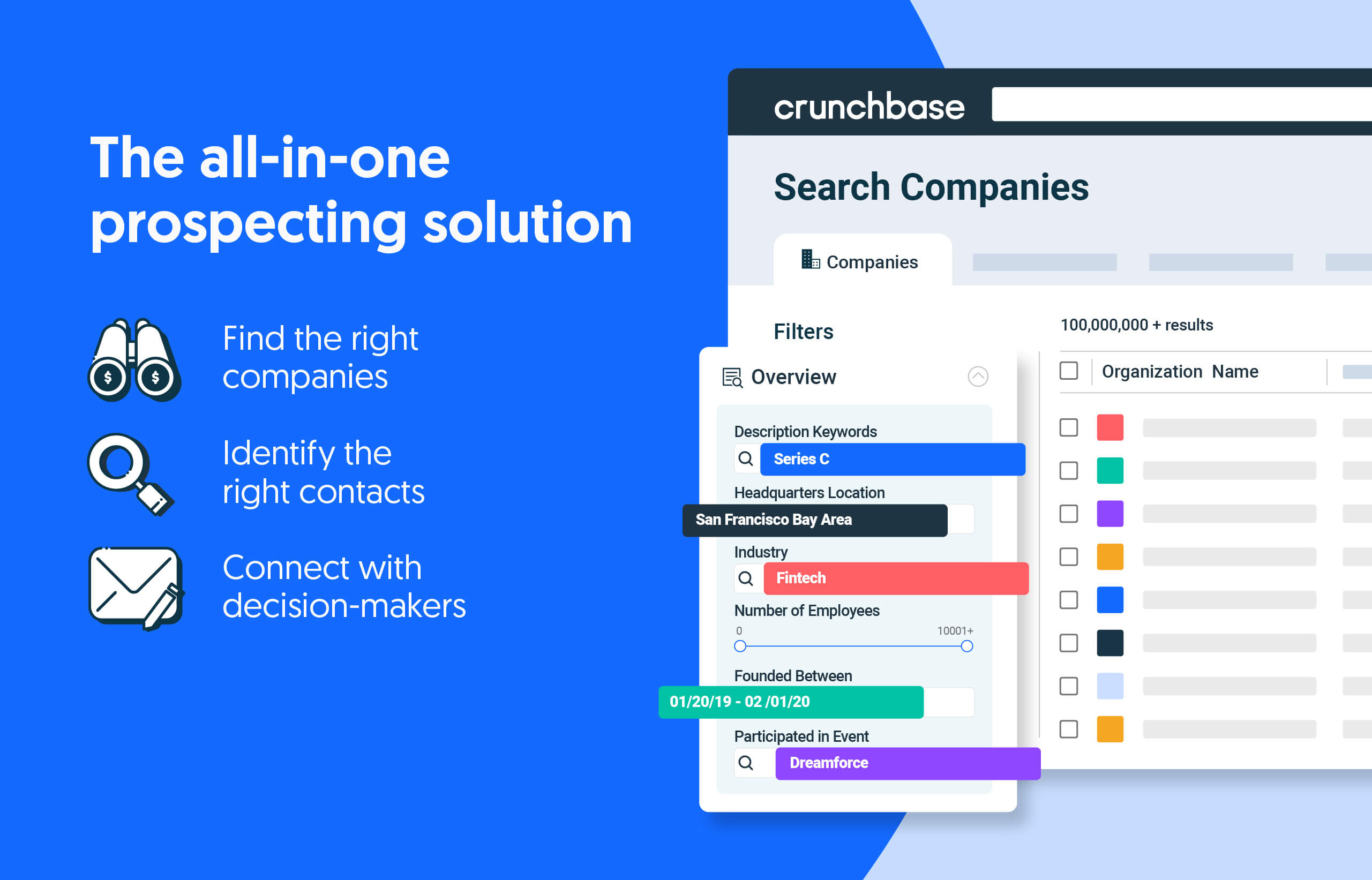

Unicorn queries

- Unicorn leaderboard (1,460)

- Unicorns in the U.S. (721)

- Unicorns in Asia (458)

- European unicorns (19)

- Emerging unicorn leaderboard (376)

- Exited unicorns (426)

Methodology

The Crunchbase Unicorn Board is a curated list that includes private unicorn companies with post-money valuations of $1 billion or more and is based on Crunchbase data. New companies are added to the Unicorn Board as they reach the $1 billion valuation mark as part of a funding round.

The unicorn board does not reflect internal company valuations — such as those set via a 409a process for employee stock options — as these differ from, and are more likely to be lower than, a priced funding round. We also do not adjust valuations based on investor writedowns, which change quarterly, as different investors will not value the same company consistently within the same quarter.

Funding to unicorn companies includes all private financings to companies that are tagged as unicorns, as well as those that have since graduated to The Exited Unicorn Board.

Please note that all funding values are given in U.S. dollars unless otherwise noted. Crunchbase converts foreign currencies to U.S. dollars at the prevailing spot rate from the date funding rounds, acquisitions, IPOs and other financial events are reported. Even if those events were added to Crunchbase long after the event was announced, foreign currency transactions are converted at the historic spot price.

Illustration: Dom Guzman

ETF Talk: AI is ‘Big Generator’

Second nature comes alive Even if you close your eyes We exist through this strange device — Yes, “Big Generator” Artificial intelligence (AI) has…

Apple gets an appeals court win for its Apple Watch

Apple has at least a couple more weeks before it has to worry about another sales ban.

Federal court blocks ban on Apple Watches after Apple appeal

A federal appeals court has temporarily blocked a sweeping import ban on Apple’s latest smartwatches while the patent dispute winds its way through…