Medtech

Remote Patient Monitoring: Providers Test Solutions in Rapidly Evolving Market

What You Should Know: Remote patient monitoring (RPM) has demonstrated promising outcomes†—including earlier intervention and reduced utilization,…

What You Should Know:

- Remote patient monitoring (RPM) has demonstrated promising outcomes†—including earlier intervention and reduced utilization, outcomes that are critical in value-based care arrangements. The options for RPM are rapidly evolving, with many factors for healthcare organizations to consider. Reimbursement is an ongoing question, with some healthcare organizations feeling they can’t rely solely on reimbursement from CPT codes.

- A new report by KLAS explores the customer experience with RPM technology in several key areas, including partnership, innovation, ease of use, and integration.

Insights Regarding Remote Patient Monitoring in 2023

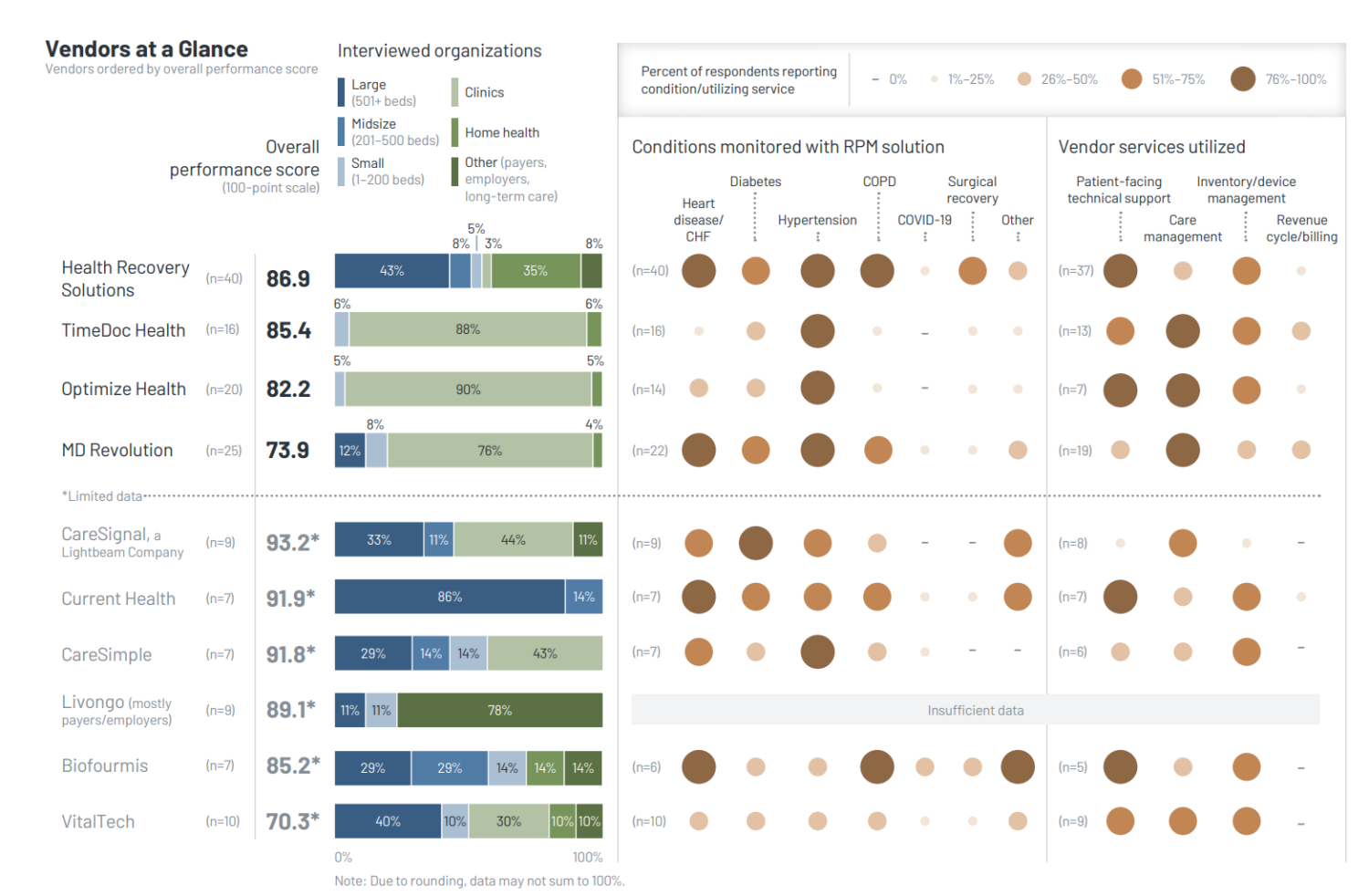

For that report, interviews were conducted over the past 12 months using KLAS’ standard quantitative evaluation for healthcare software, which was composed of 16 numeric ratings questions and 4 yes/no questions, all weighted equally. Combined, the ratings for these questions made up the overall performance score, which was measured on a 100-point scale. The questions were organized into six customer experience pillars—culture, loyalty, operations, product, relationship, and value.

Key insights from KLAS’ latest report concerning remote patient monitoring are as follows:

- Health Recovery Solutions Offers Strong Partnership; Some Customers Question Their Pace of Innovation: Health Recovery Solutions (HRS), a multiyear Best in KLAS winner, serves large organizations with comprehensive programs covering multiple conditions and care settings. HRS forges strong partnerships and is perceived by customers as invested in their success. While some customers appreciate HRS’ integration with electronic medical records (EMR), others desire deeper and more automated integration of patient data. Although customers exhibit loyalty, a few express concerns about HRS’ innovation not keeping pace with the market and growth hindering development promises. Desired improvements include continuous monitoring, better inventory management, an enhanced video visit tool, and an updated UI for tablets. In the sphere of remote patient monitoring (RPM), Biofourmis and Current Health offer continuous monitoring capabilities, viewed as a significant advancement. Biofourmis customers, varying in size, consider the vendor innovative and a strong partner, but have mixed feedback on solution integration and ease of use. Current Health, acquired by Best Buy in 2021, is described by mostly large organization customers as collaborative, responsive, and dedicated to meeting customer needs, despite occasional slower development.

- MD Revolution Customer Experience Highly Dependent on Account Management Quality: Satisfaction among MD Revolution customers, especially clinics monitoring patients with hypertension and/or heart disease, is heavily influenced by their experience with the assigned account manager. Satisfied customers can guide the spotlight on engaged contacts who contribute to positive financial outcomes by enabling efficient monitoring of a larger patient volume. However, many customers express frustration with account managers who lack proactive communication, fail to address concerns, and do not assist in establishing appropriate care management protocols and expectations. Some customers also express dissatisfaction with slow development and issues related to electronic medical records (EMR) integration. On the other hand, VitalTech customers, although limited in available data, utilize the vendor’s solution for monitoring various conditions. Nevertheless, over half of these customers plan to replace the solution due to reasons such as unreliable support, a lack of proactive account management, and perceived limitations in advanced functionality.

- TimeDoc Health and Optimize Health Stand Out for Ease of Use: TimeDoc Health and Optimize Health are both recognised for their user-friendly solutions, which is especially beneficial for RPM efforts targeting Medicare patients who may be less familiar with technology. Most of the interviewed customers, primarily clinics, utilize these vendors’ solutions to monitor patients with hypertension, often making use of patient-facing technical support, care management, and inventory/device services. TimeDoc customers appreciate the helpfulness of the vendor’s personnel, although feedback on integration and reporting is mixed, with some customers expressing desires for deeper EMR integration. Optimize Health customers, who typically purchase devices upfront, find the support resources to be responsive but note a lack of proactive engagement and occasional device issues. CareSimple, with limited data available, stands out for its distinguished ease of use, as highlighted by a mix of clinic and health system customers using it for monitoring heart disease and hypertension, and they commend the vendor’s support and relationships.

healthcare

health

medical

device

devices

remote patient monitoring

software

buy

ETF Talk: AI is ‘Big Generator’

Second nature comes alive Even if you close your eyes We exist through this strange device — Yes, “Big Generator” Artificial intelligence (AI) has…

Apple gets an appeals court win for its Apple Watch

Apple has at least a couple more weeks before it has to worry about another sales ban.

Federal court blocks ban on Apple Watches after Apple appeal

A federal appeals court has temporarily blocked a sweeping import ban on Apple’s latest smartwatches while the patent dispute winds its way through…