Life Sciences

Trading Cathie Wood’s ARKK as It Tries to Break Out Over Major Resistance

The prominent asset manager’s ARKK ETF has done pretty well this year but is struggling against a major resistance area.

As we progress through 2023, it’s clear that just a handful of stocks continue to drive a bulk of the gains in the S&P 500.

We have not seen a big influx back into growth stocks, although overall this group is trading better than it was in 2022, and a few of its components have roared back to life.

Specifically, names like Trade Desk (TTD) – Get Free Report, Shopify (SHOP) – Get Free Report, MongoDB (MDB) – Get Free Report, Tesla (TSLA) – Get Free Report and others have performed quite well.

Don’t Miss: Fixer Upper? How to Trade Home Depot Stock After Earnings Dip.

Many investors prefer to use the asset manager Cathie Wood’s ARK Innovation ETF (ARKK) – Get Free Report as a proxy for growth stocks. While Ark has several ETFs — homing in on everything from fintech to genomics — the most popular one is ARKK, which is almost four times larger than the next largest Ark ETF.

For its part, ARKK has actually done pretty well this year. Despite today’s 2% decline, the shares are up almost 21% so far in 2023. That slightly edges out the Nasdaq’s 18.2% year-to-date gain, which is the top U.S. index so far this year by performance.

Investors’ lack of risk-on appetite shows, given that growth stocks are still struggling to maintain upside traction.

Buy or Sell the ARKK ETF?

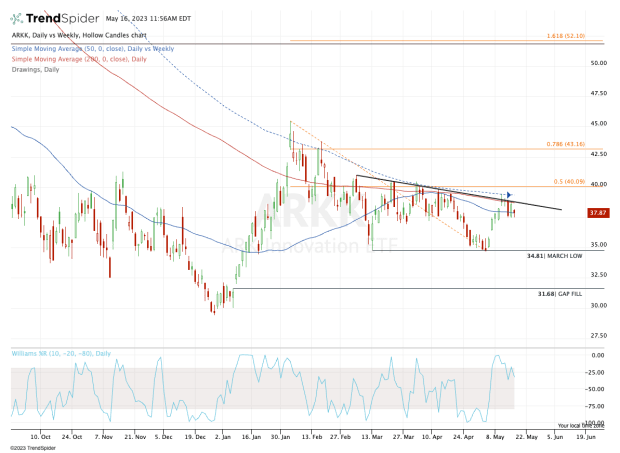

Chart courtesy of TrendSpider.com

The chart above looks busy, as it incorporates a few daily and weekly measurements. It helps us, however, paint a more accurate picture of what’s going on — and what could happen going forward.

Currently, the stock is struggling to close above the 200-day and 50-week moving averages, as well as downtrend resistance.

If the ARKK ETF can close above $40, not only will it clear these measures, it will also regain the 50% retracement from the recent low to the 2023 high.

In that scenario, it would open the door up to the $42.50 to $43 area. Above that could very well put the 2023 high back in play near $45.50.

Ultimately, long-term bulls are looking for a move above this year’s high and for a rally into the $50 to $53 area. That zone has been significant in the past and also marks the 161.8% extension from the current range.

Don’t Miss: Do Tax Credits Make First Solar Stock a Buy? Here’s What the Chart Says

What happens if ARKK can’t regain the 50-week and 200-day moving averages? Then it’s still vulnerable to the dips.

There’s a downside gap-fill level at $35.90. Below that and the March, April and current May low are all within a few cents of the $34.80 area.

So if the selling pressure picks up, this becomes a key area to hold. If it fails, it could create a multimonth rotation to the downside, ultimately putting the $31.70 to $32.70 zone in play.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.

Wittiest stocks:: Avalo Therapeutics Inc (NASDAQ:AVTX 0.00%), Nokia Corp ADR (NYSE:NOK 0.90%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Spellbinding stocks: LumiraDx Limited (NASDAQ:LMDX 4.62%), Transocean Ltd (NYSE:RIG -2.67%)

There are two main reasons why moving averages are useful in forex trading: moving averages help traders define trend recognize changes in trend. Now well…

Asian Fund for Cancer Research announces Degron Therapeutics as the 2023 BRACE Award Venture Competition Winner

The Asian Fund for Cancer Research (AFCR) is pleased to announce that Degron Therapeutics was selected as the winner of the 2023 BRACE Award Venture Competition….