Wellness

MoneyTalks: Ron Shamgar says these 3 ASX engines won’t wait for Santa to Rally

Two key themes have emerged this year: robust business performance and enticing corporate takeover opportunities. Here’s some of them. … Read More

The…

MoneyTalks is Stockhead’s regular drill down into what stocks investors are looking at right now. We’ll tap our extensive list of experts to hear what’s hot, their top picks, and what they’re looking out for.

Today we hear from Tamim Asset Management head of Australian equity strategies Ron Shamgar.

For some investors, Santa Claus has come a little earlier this year.

In November, the S&P 500 ended the month with an impressive surge, just under 9%, while the tech-heavy Nasdaq posted gains of nearly 11%.

The Nasdaq Composite is up 52% YTD.

The S&P500 is up 23% YTD and the Dow Jones has gained 12.5% YTD, sitting comfy at record highs.

However closer to home, the ASX All Ords (XAO) benchmark index in Australia has offered ‘a more modest uptick’ of 1.3%, says Shamgar.

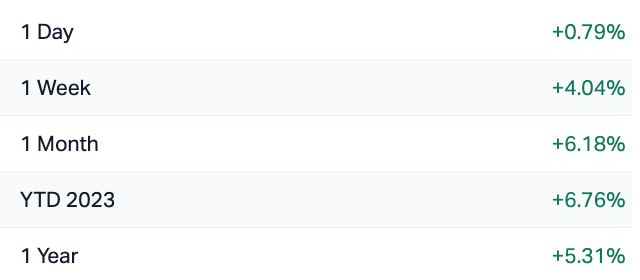

ASX All Ordinaries (XAO) index performance

“It’s a positive stride,” says Ron, “though not quite matching the strides seen in the US.”

“This leaves investors pondering the possibility of a ‘Santa Rally*‘ to further bolster the market’s performance.”

“December brings with it the prospect of adding to this year’s gains. Historically, barring years when the market was down, this month has been favourable for investors.”

*Ed: ‘Santa Rally’

A market’s tendency to rise in the last five trading days of the year, and the first two of the new year. First documented by Yale Hirsch in 1972. Since 1950, the S&P500 averages +1.5% gain during these seven days. The pattern is consistent for 34 of the past 45 years – over 75%.

While tech giants have shown robust performance, aligning with the prevailing trends among most mega-cap stocks, they weren’t the sole contributors to the market’s uplift, according to Ron.

“In our TAMIM portfolios, two key themes have emerged this year: robust business performance and enticing corporate takeover opportunities. Steering clear of the flashy themes such as AI, we have sought value in less explored areas. It is in these overlooked niches where we often find the most promising opportunities.”

In this regard, Ron says small businesses ‘remain the lifeblood of daily life and the backbone’ of every economy.

“Despite the dominance of tech giants like Google (GOOG), Microsoft (MSFT), and Amazon (AMZN), millions of everyday transactions still occur outside their reach. Consider the simple acts of buying a coffee or a beer – the ubiquitous tap of a phone or card is a testament to the ongoing digital revolution in payments.

“This transformation towards digital transactions, significantly accelerated by the COVID-19 pandemic, has opened doors for companies like SmartPay,” Ron says.

SmartPay (ASX:SMP)

Excelling across the digitised landscape, SmartPay (ASX:SMP) is capitalising on the new era of electronic transactions, particularly in the bustling small business sector.

To catch you up, Smartpay designs, develops and implements innovative payment solutions for customers in New Zealand and Australia. Its headline mission: To be recognised as the most reliable, capable, agile and innovative omni-channel payments provider in Australia and New Zealand.

Bold words, but TAMIM notes the company is already a pioneering player in the payment solutions sector. Ron says SMP has quietly emerged as ‘a key facilitator for small businesses seeking seamless operational EFTPOS integration.’

SMP is a profitable and growing business, with circa 17,700 active terminals in Australia and commanding a significant 25% market share in New Zealand with around 30,000 terminals.

As the largest non-bank merchant terminal provider, SmartPay competes effectively with Tyro Payments (ASX:TYR) and major banking institutions.

SMP vs TYR Year-to-date

According to Ron, the company’s growth in Australia is propelled by its acquiring model, where it levies a merchant service fee on each transaction, allowing it to tap directly into the ‘vast market opportunity’ presented by over 1 million terminals predominantly under bank control.

“Focusing on smaller businesses, especially in hospitality and beauty, SmartPay distinguishes itself in this competitive landscape,” Ron says.

Although the banking sector’s involvement in this area is more peripheral, emerging challengers like Block Inc (ASX:SQ2), Stripe, Lightspeed, and Tyro present a dynamic competitive environment.

SMP vs SQ2 Year-to-date

“SmartPay could ‘potentially see its earnings surge to quadruple its FY23 result over the next five years,” Shamgar says.

“SmartPay’s revenue stream is closely tied to consumer spending trends, as transaction volumes directly influence its fee collection… but the growth lever is in the New Zealand market.”

SMP has a foothold of roughly 25% of the terminal market in New Zealand, according to TAMIM research.

Until recently, the company’s revenue model in New Zealand has been a monthly rental rather fee per unit than a per transaction fee like the Australian division (along with ancillary services fees, the company terms this its “acquiring model”).

TAMIM note this is all set to change with the new Cuscal partnership readying to transform the New Zealand market.

“The upside is not just in new customer acquisition for SmartPay, but where the company can convert its existing New Zealand client base to the acquiring model. That opportunity could result in $120 million revenue upside at 50% margin,” Ron reckons.

And over the long run, he adds, the SMP share price has provided ‘exceptional returns’ for shareholders.

Here’s SMP lately…

And here’s…

SMP vs the ASX Small Ords (XSO) Index 5-years

According to the latest SMP market update, the company’s net cash position with funds in the bank (end September 2023) was $19 million.

“Should the company reach the levels we feel it is capable of, the current price could be a very attractive opportunity for long-term investors,” Ron suggests.

“Alternatively, if Smartpay continues to make waves we see it as a potential takeover target from the banks or a potential international acquirer looking to get a foothold in New Zealand and Australia.”

Over the last half-year, SMP delivered significant growth for normalised Profit Before Tax (up +68%,) reaching $4.8 million. This flowed through to a 64% growth in normalised Net Cash, reaching $2.2 million.

“The improving profitability reflects the robust operating leverage and successful execution of Smartpay’s Australian strategy, while at the same time making significant strides toward the entry into the New Zealand acquiring market.”

Adore Beauty (ASX:ABY)

Adore is a pureplay online beauty retailer with its flagship platform, adorebeauty.com.au, focusing on the 41-50 year old female demographic, with plans to expand its product/SKU offering into its own in-house brand – which offer much larger margins for the company.

Currently it has three house-owned brands: ‘Adore Beauty’, ‘AB LAB’ and ‘Viviology’.

Ron says much of the focus next year will be on continued margin and cost improvement, and leveraging its healthy balance sheet to look into investments in key short, mid and long-term strategic initiatives.

“Investors have been scrambling to buy the online beauty retailer’s shares after it confirmed the receipt of a takeover offer. The stock has been one of the ASX standout performers over the last month. In the first week of December, the share price rocketed, surging 22.99%.”

Here’s ABY lately…

According to the ASX, ABY received a non-binding, conditional, and indicative proposal from THG Plc (LSE: THG) to acquire 100% of Adore Beauty’s outstanding shares.

London-listed THG, also known as The Hut Group, is a British e-commerce company that sells own-brand and third-party cosmetics, dietary supplements, and luxury goods online.

THG proposed to acquire Adore Beauty by way of a scheme of arrangement for $1.25 to $1.30 cash per share, subject to various conditions including due diligence.

This offer price represents a 33.7% to 39% premium to where the small-cap ASX share ended the prior week.

However, Ron says, it hasn’t been enough to get a deal over the line.

Adore declined the offer, the Board saying it fails accurately reflect the company’s value, while management remains ‘focused on maximising value for all shareholders’:

“Following a review of the terms of the Proposal with the assistance of its financial and legal advisers, the Board of Adore Beauty (Board) concluded that the Proposal undervalued the Company, was unable to be implemented, and was not in the best interests of shareholders. For these reasons, the Board rejected the Proposal.”

By the ABY numbers…

“Adore also remains on track to achieve an EBITDA margin of 2 to 4 per cent this financial year and is targeting 8 to 10 per cent EBITDA margins in 2027, and 10 per cent growth long-term, driven by private label product expansion and more returning customers shopping via its app.”

Here’s where ABY was placed last quarter:

● Revenue of $47.5m, up 4.7% on the prior corresponding period (PCP)

● Active customer numbers return to growth, up 1.5% on PCP to 803k

● Record 497k returning customers, up 4.7% on PCP

● Newly launched subscription service across 18 brands; mobile app now representing more than 26% of all revenue; new partner brands added; private label continues to grow

● On track to achieve EBITDA margin of 2-4% in FY24

Gentrack Group (ASX:GTK)

In the past year, Gentrack’s share price has rocketed an impressive 155%, Ron notes.

The company, a provider of software solutions for utility companies and airports globally, boasts a diverse clientele including notable names like EnergyAustralia, Npower, Melbourne Airport, Sydney Airport, Gatwick, Schiphol, Orlando International Airport, and Auckland International Airport (ASX:AIA)

Originating from New Zealand’s power market deregulation 25 years ago, Gentrack has worked itself into a position as a trusted name in software solutions for operational efficiency and customer engagement. Its platforms are instrumental for utilities and airports adapting to rapid global changes and seeking sustainable futures.

“Now, Gentrack operates globally, with over 200 clients in 20 countries and offices in key locations including the UK, Australia, New Zealand, and the USA. We think they’ve had a breakout year,” Ron says.

Gentrack’s 2023 has been marked by significant growth across its FY23 full-year results.

GTK by the numbers…

“This achievement is attributed to the acquisition of new customers and a strong recovery from COVID-19, especially in the airport sector.”

The company’s FY23 revenue saw a substantial increase of 34.5% year-over-year, reaching $169.9 million. Its annual recurring revenue experienced a 51.2% boost to $105 million, and its operating earnings (EBITDA) skyrocketed by 185% to $23.2 million.

GTK vs GTK Year-to-date

Ron says that the growth in both the Utilities and Veovo sectors has enabled Gentrack to upwardly revise its FY24 revenue forecast.

“Initially projected to be between $157 million and $160 million, the new guidance sets the revenue target to match or exceed FY23’s figure of approximately $170 million. This upward revision comes despite losing one-off revenues of $27.6 million from insolvent UK customers.

“Correspondingly, the EBITDA forecast is now narrowed to be between $20.5 million and $25.5 million, as opposed to the earlier range of roughly $19 million to $27 million.”

Ron says Gentrack’s success in the Utilities segment is rooted in expanding relationships with both new and existing energy customers.

“A notable highlight was Genesis Energy selecting Gentrack’s new g2.0 solution in November 2023, a testament to the confidence in Gentrack’s product strategy. Similarly, EnergyAustralia launched its ‘Solar Home Bundle’ on Gentrack’s platform, showcasing groundbreaking distributed energy management solutions.

“Gentrack also plays a crucial role in supporting over 50% of UK businesses with water solutions. A significant achievement was the migration of Scottish Water Business Stream’s 200k+ business customers to Gentrack’s cloud-based platform… And in Fiji, Gentrack is set to transform the Water Authority of Fiji’s platform, further highlighting its impact in its core markets.”

Targeting global expansion

Gentrack’s expansion strategy has seen it extend its reach beyond its core markets of the UK, Australia, and New Zealand.

“In November 2022, the company opened an office in Singapore to support local operations and explore opportunities in Southeast Asia. European business development, anchored from London, has also been progressing well.

“This year, Gentrack established a Middle Eastern regional hub in Saudi Arabia, securing its first Utilities contract win in the region in October 2023. We think this achievement demonstrates the strength of Gentrack’s partnership with Salesforce and the potential of its g2.0 platform.”

Growing airport customers

The aviation sector’s post-COVID recovery has also led to a surge in demand for Gentrack’s digital transformation solution, Ron adds.

“Veovo has acquired new tier 1 and 2 customers in the Middle East and Europe, seen strong demand for platform upgrades, and explored expansion opportunities in Passenger Flow solutions.”

“Gentrack’s significant investment in research and development, and increased sales and marketing efforts, are key drivers for its international expansion. The company’s continued success in winning new customers and transitioning them to its software platforms is a crucial factor for future share price growth.

One last word from Ron…

…It’s Christmas, but exercise Optimism together with Caution

“As we look forward to the possibility of a ‘Santa Rally’ to cap off a successful 2023, we remain cautiously optimistic.

“While we cherish the momentum we’ve seen this year, we recognise that relying on seasonal trends is not a substitute for a sound investment strategy,” Ron says.

“Our focus continues to be on identifying and capitalising on high-quality investment opportunities, driven by thorough analysis and strategic foresight.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

The post MoneyTalks: Ron Shamgar says these 3 ASX engines won’t wait for Santa to Rally appeared first on Stockhead.

Lion’s Mane Mushroom: History, Benefits, and Adaptogen Properties

Explore the intriguing world of Lion’s Mane Mushroom in our comprehensive guide. Dive into its unique properties, historical significance, and myriad health…

AI can already diagnose depression better than a doctor and tell you which treatment is best

Artificial intelligence (AI) shows great promise in revolutionizing the diagnosis and treatment of depression, offering more accurate diagnoses and predicting…

Reasons You should Get this: Neptune Wellness Solutions Inc (NASDAQ:NEPT), WeTrade Group Inc. (NASDAQ:WETG)

NEPT has seen its SMA50 which is now -9.28%. In looking the SMA 200 we see that the stock has seen a -92.25%. WETG has seen its SMA50 which is …

The…