Wellness

The Ethical Investor: Gender diversity’s state of play in the workplace

McKinsey’s latest Women in the Workplace report finds women are demanding more from work and leaving companies at record rates … Read More

The post…

The Ethical Investor is Stockhead’s weekly look at ESG moves. This week’s special guest is Seven Advisory’s Mary Delahunty.

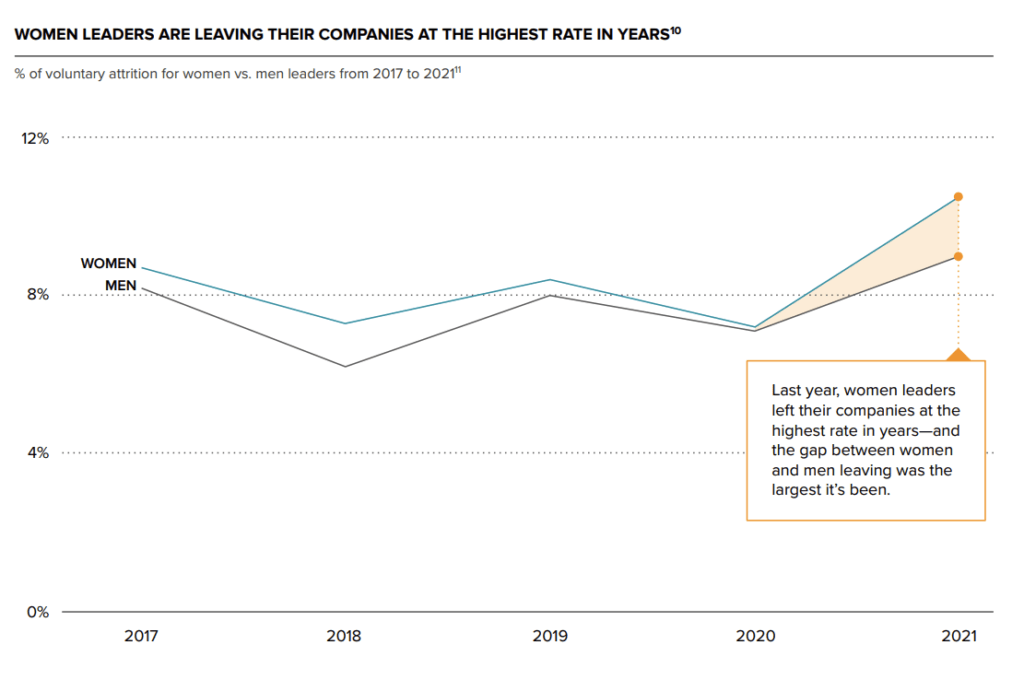

McKinsey’s latest Women in the Workplace report with LeanIn.org finds women are demanding more from work and leaving companies at record rates to get it.

Calling this ‘The Great Break Up’, the report finds it’s increasingly important to women that they work for companies that prioritise career advancement, flexibility and employee wellbeing and are leaving in unprecedented numbers when these needs aren’t met.

In fact, McKinsey says they are switching jobs at the highest rate in years, and at a much higher rate than male leaders.

“To put the scale of the problem in perspective: for every woman at the director level who gets promoted to the next level, two women directors are choosing to leave their company,” the report says.

Women are still underrepresented in the workplace

Despite modest gains in representation over the last eight years since McKinsey has been conducting this report, women – and especially women of colour – are still dramatically underrepresented.

“This is especially true in senior leadership: only 1 in 4 C-suite leaders is a woman, and only 1 in 20 is a woman of colour,” McKinsey highlights.

One of the biggest obstacles women face on the path to senior leadership is at the first step up to manager, thanks to the ‘broken rung’ – a term used to describe the phenomenon where women in entry level positions are promoted to managerial positions at much lower rates than men.

For every 100 men who are promoted from entry-level roles to manager positions, Mckinsey says only 87 women and only 82 women of colour are promoted.

As a result, men significantly outnumber women at the manager level, and women can never catch up.

“There are simply too few women to promote into senior leadership positions,” the report says.

If companies continue down this trend, the report warns businesses will lose more than just their current leaders – they’ll likely deter the next generation of leaders too.

ESG interview: Mary Delahunty on gender diversity

Delahunty is the former Head of Impact for Aussie super fund HESTA and founder of Seven Advisory, an organisation that helps companies progress sustainably with purpose and impact.

Where does diversity fit into ESG?

“I think it fits into both the ‘S’ and ‘G’ considerations,” Delahunty says.

“In G when we think about gender diversity in terms of value, you look at whether or not the governance structures within your organisation allow for the true discovery of value that comes from diversity.

“It fits in there nicely but having said that, everything sort of fits into G anyway – everything starts with governance.”

What is the best way to measure gender diversity?

“It is not in and of itself one thing.

“Firstly, I think for organisations to understand what gender diversity can either bring or how it affects the way their company runs they need to deep dive into what it means to them as an organisation.

“For example, if you’re sitting in a developed world like Australia and you’re making widgets and you’re selling those widgets in shopping centres then gender diversity might mean to you the ability to bring a diverse range of views about how those widgets should be made and sold around your boardroom and executive table.

“But if you’re a company that has wide reaching global ambition, you might need to know how you sell into markets that have gender diversity issues, for example, or you might need to know how it plays out in your supply chain.

“I think your measurement approach can depend on the change you want to make, and that’s the crucial element of it.”

How does it impact the valuations of a company, if at all?

“Gender diversity in boardrooms and executive settings can drive value in companies both in the short term and in the longer term – there’s been several studies that have been done that show just that,” Delahunty says.

“McKinsey’s study is the most often quoted – I think gender diversity, as a proxy for broader diversity, shows that when a company intentionally seeks a broad range of views, they can drive a real value advantage, so it shows in their share price for example.

“It makes sense really, when you consider that gender diversity is a proxy for contemporary thinking and fairness then that does have a bottom-line effect.”

What are some issues surrounding gender diversity?

“It’s pretty misunderstood in its application and affect and is often pursued through a fairness angle.

“Which is good and fine but then you tend to forget about that value angle, and then sometimes it’s looked at as a ‘Oh well we better tick a few boxes here and get some women on the board and keep the investors happy’ which doesn’t necessarily create culture change.”

What are some ways a company can become more gender diverse?

“One way to do it, and it sounds difficult, is with authenticity – look through the entire organisation with a gender lens,” Delahunty says.

“Don’t think about putting women in but think about how it is that people who identify as women or any other gender start to use your product or your services and then think about how that should be represented in your company.

“Start from the outside-in instead of thinking ‘if I put a woman on the board, it will all be fixed’.”

“Because if the problem that we’re seeking to solve is something around equity and fairness and therefore value, then it’s more of a broader approach as compared with ‘Oh let’s just pop a woman on the board and see what happens’.”

What are some good examples of companies that have embraced gender diversity?

“Companies are in different stages of their maturity in understanding diversity, and there are a number of organisations in the United States, for example, who collect data broader than gender on diversity,” Delahunty says.

“There’s an index provider or research organisation out of the Netherlands called Equileap and they have public documentation about companies that they believe to be doing well in this area.

“Equileap also have a look at those metrics and round them up to make an investment case – as in, ‘invest in these companies because we think they’re going to outperform’ – they provide an index to investors and encourage investors to pick that as an investment thesis.

“They have collected data on companies that are doing well and while Australia is still quite focused on gender diversity you can see from their research in the US where other companies are focused on broader diversity that we’ve still got a long way to go.

“But I think it’s widely accepted that gender is a bit of a proxy for broad diversity, and probably works well in that way.”

Is there anything else that you’d like to add?

“These things are not easily fixed but looking at the pipeline of talent development to get a better diverse workforce is important and while investors are keen to see results and woman on the board right now, there are several people working on the talent pipeline and that will take time,” Delahunty says.

“It’s not going to happen unless we have quotas and targets and a genuine understanding that this is the way the world should go.

“There’s an organisation called 4040 Vision and that’s about the diversity in executive ranks – it calls on companies to make public commitments to gender parity along certain timelines, so there’s no legislative target and quota but the Victorian Government ensures their boards and statutory authorities are representative.

“It’s a piecemeal approach – I do think saying things out loud is the best way to get things done and quotas and targets are very different things obviously.”

The post The Ethical Investor: Gender diversity’s state of play in the workplace appeared first on Stockhead.

Lion’s Mane Mushroom: History, Benefits, and Adaptogen Properties

Explore the intriguing world of Lion’s Mane Mushroom in our comprehensive guide. Dive into its unique properties, historical significance, and myriad health…

AI can already diagnose depression better than a doctor and tell you which treatment is best

Artificial intelligence (AI) shows great promise in revolutionizing the diagnosis and treatment of depression, offering more accurate diagnoses and predicting…

Reasons You should Get this: Neptune Wellness Solutions Inc (NASDAQ:NEPT), WeTrade Group Inc. (NASDAQ:WETG)

NEPT has seen its SMA50 which is now -9.28%. In looking the SMA 200 we see that the stock has seen a -92.25%. WETG has seen its SMA50 which is …

The…